unlevered free cash flow vs fcff

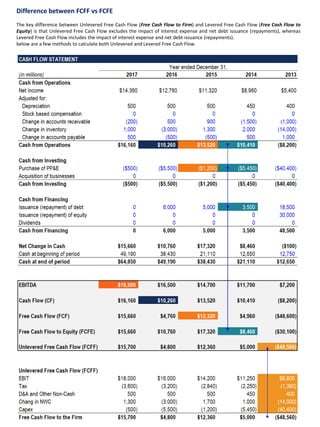

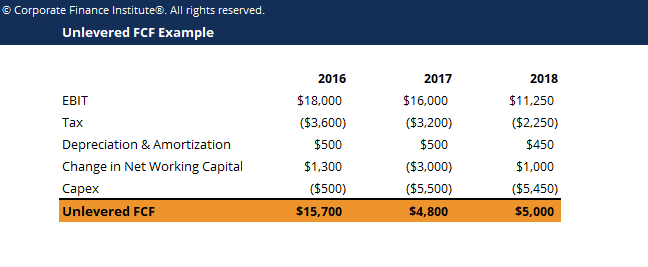

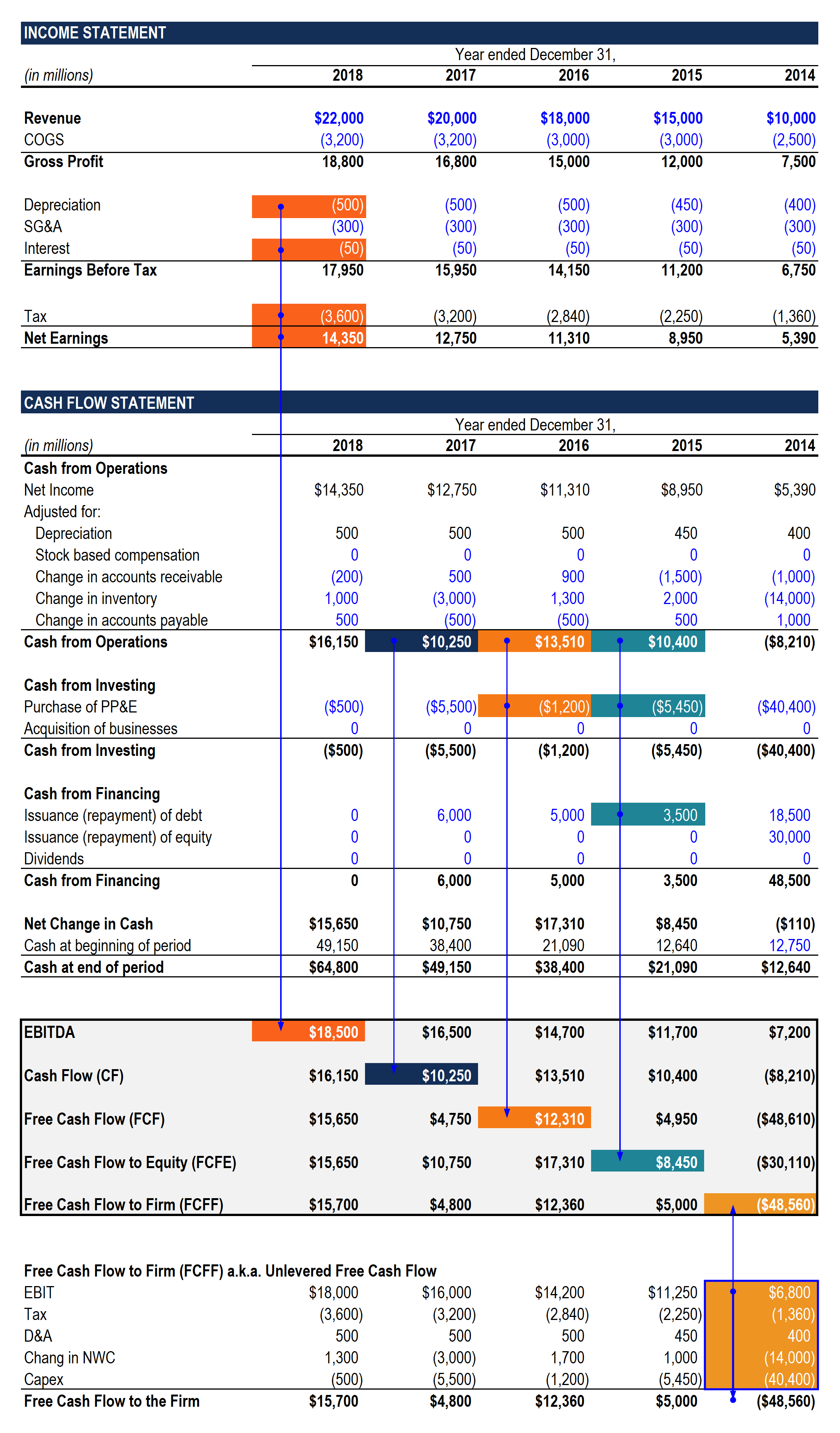

Think about these types of cash flow in terms of a before and after state. For this scenario unlevered free cash flow is the before state and levered free cash flow is the after.

Free Cash Flow To The Firm Vs Cash Flow Available For Debt Service Fcff Vs Cfads Youtube

Is FCFF unlevered.

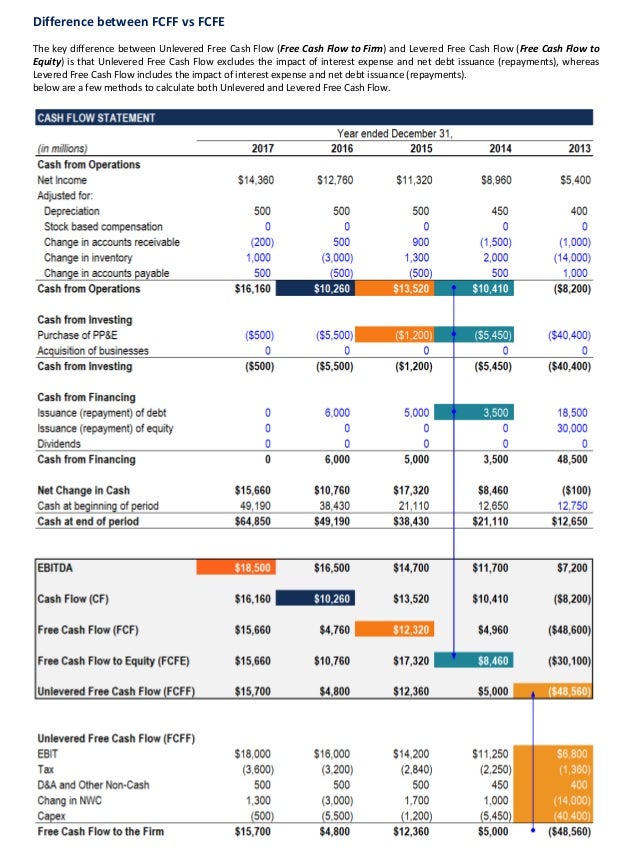

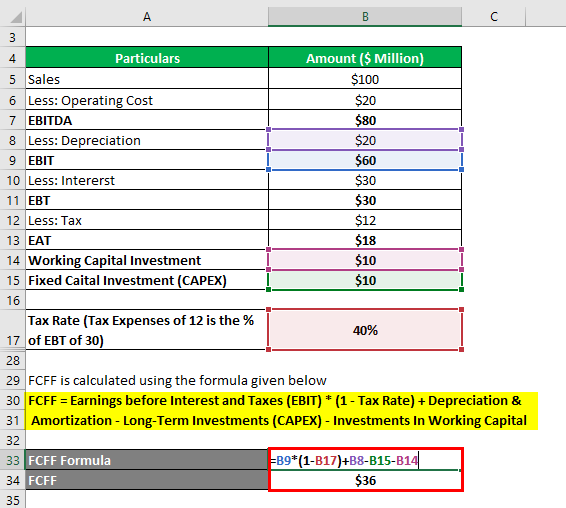

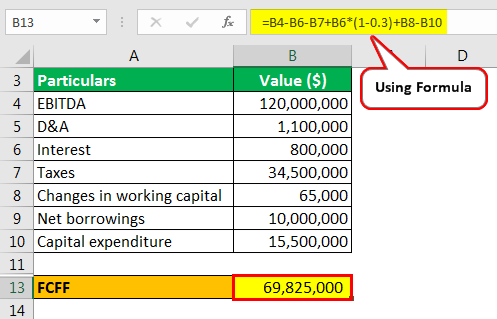

. Unlevered FCF is FCF to the enterprise ie the firm. What is Levered Free Cash Flow. FCFF EBIT 1-t Depreciation.

It is vital to understand. The formula to calculate the unlevered free cash flow for a company is the following. Free cash flow to the firm is synonymous with unlevered free cash flow.

How Do You Calculate Unlevered Free Cash Flow. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. FCFF is not the same as CFO - CAPEX because.

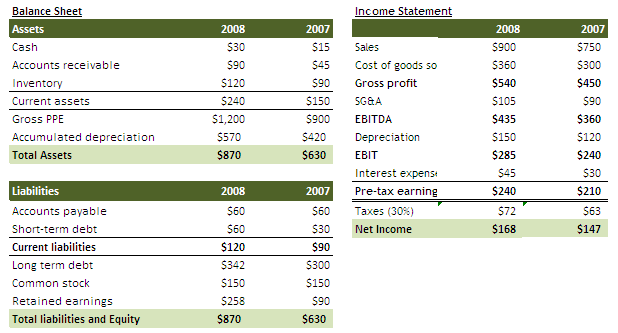

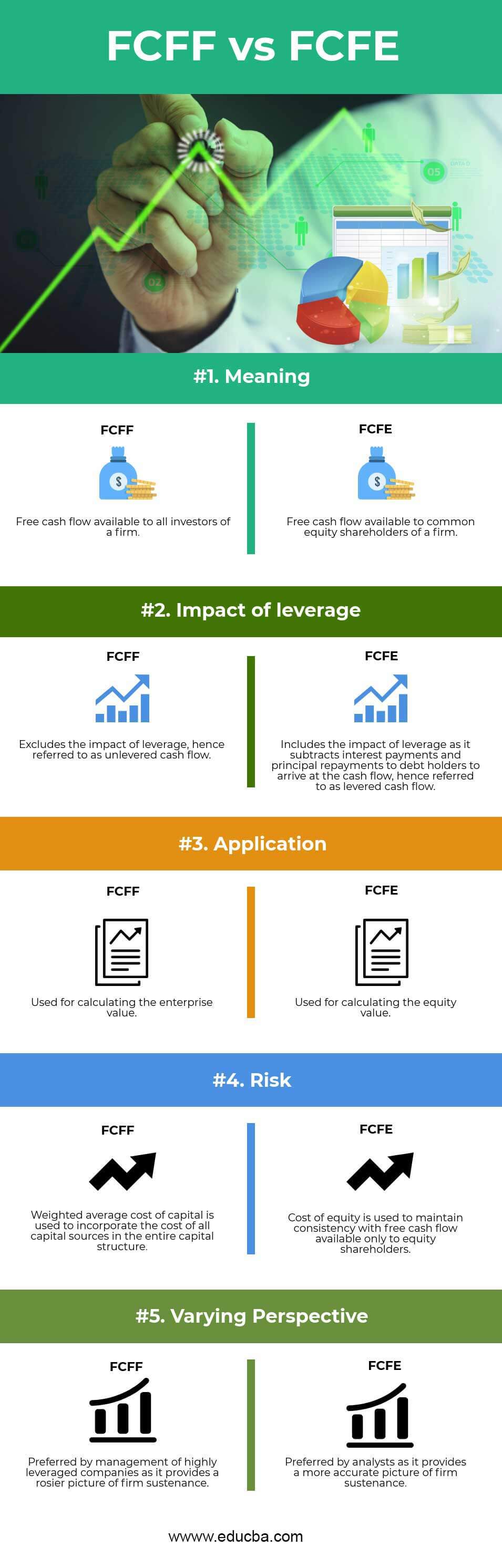

Free cash flow FCF on the other hand is the money a. The FCFF and FCFE which are acronyms for Free Cash Flow for the Firm and Free Cash Flow to Equity are the two types of free cash flow measures. Used to value equity with a Cost of Equity discount rate only.

One could argue that the value of these free cash flows at the end of year 3 can be calculated with the formula for a perpetual of. Unlevered free cash flow is the cash flow a business has excluding interest paymentsEssentially this number represents a companys financial status if. FCFE Free Cash Flow to Equity Levered Free Cash Flow LFCF The value of a company if all debt was paid off.

The unlevered cash flow also known as the Free Cash Flow of the Firm FCFF is available to all the equity and debt holders of a company post the deduction of operating expenses capital. FCFF stands for free cash flow to firm and represents the cash generated by the core operations of a company that belongs to all capital providers both debt and equity. Free Cash Flow to Equity While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for.

The free cash flow can also be calculated via another route. In short the free cash flow to equity is the cash flow that a business generates after taxes reinvestment and debt payments interest and principal. Unlevered free cash flow UFCF is the amount of available cash a firm has before accounting for its financial obligations.

The free cash flow to the firm.

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff

Discounted Cash Flow Analysis Street Of Walls

Fcff Formula Examples Of Fcff With Excel Template

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Unlevered Free Cash Flow Definition Examples Formula

Fcff Vs Fcfe Top 5 Useful Differences With Infographics

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download

Discounted Cash Flow Analysis Street Of Walls

What Is Free Cash Flow Calculation Formula Example

Unlevered Free Cash Flow Formula And Calculator Step By Step

Free Cash Flow Yield Formula And Calculator Step By Step

What Is Levered Free Cash Flow Definition Meaning Example

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Cash Flow The Ultimate Guide On Ebitda Cf Fcf Fcfe Fcff Youtube

What Is Free Cash Flow And Why Is It Important Example And Formula Article